Advice and Counsel on Which Decision Makers Rely

Corporate Financial Advisory

The Internet age and globalization spawned a 24/7/365 business cycle and changed the way investment and commercial banks interact with companies that need access to capital markets. Relationship banking, the time-honored process whereby a banker courts a business and learns its complexities from the ground up, has all but vanished in the frenetic world of transactional deal-making.

Today, senior bankers show up in boardrooms to make the key new business pitch and then quickly hand off deal execution to smart, able, young capital markets practitioners who are securities markets savvy but lack the ability to relate to C-suite executives and the board of directors pricing committee.

The result is all too often a hurry-up deal execution where the deal becomes the client, and the client is left to watch the transaction from a “safe” distance. At the precise moment when judgment and experience should trump technical expertise, the senior banker (“rainmaker”) who won the mandate is likely to be far afield, making yet another new business pitch.

Giving corporate financial advice and counsel acquired from years of hands-on deal-making is an art, not a science. It is a rare deal that proceeds elegantly from idea to incubation to completion. Management of issuer client expectations is a critical, but often ignored, element in the public offering/private placement/M&A process.*

CEOs increasingly find comfort in having a trusted confidant (whose fee is not dependent upon a transaction) at their side during the many stressful moments of the deal at hand, an interpreter who speaks investment banking.

Corporate insiders understandably struggle to deliver bad news to CEOs for fear of jeopardizing their own employment status. South Beach Capital Markets has no such impediment. Our independence allows us to offer unfettered, unvarnished advice to CEOs, CFOs, and boards of directors whom the deal-making process all too often orphans. Playing the role of devil’s advocate, we tell clients what we think rather than what we think clients want to hear.

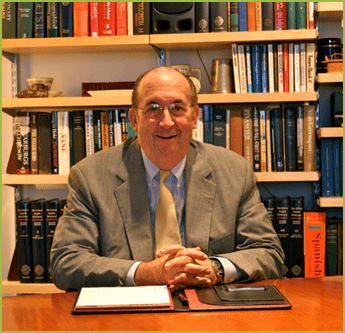

Bruce Foerster, founder and president of South Beach Capital Markets, has “seen the movie before.” While the characters may change, the plot rarely does. He brings both requisite deal-making experience and mature judgment (the “adult in the room”) to a corporate financial advisory engagement.

*NOTE: South Beach Capital Markets Advisory Corporation is not an SEC-registered, FINRA-member broker/dealer. We do not undertake capital–raising assignments. We are strictly in the advice-giving business.

Lecturer in the Master of Science in Finance Program at the University of Florida

Securities Industry Capital Markets Handbook

Contact

Thank you for your interest.

Phone

305-965-6787

Fax

321-622-5682

Hours of Operation

24/7/365

Service Area

New York, Florida, and The World

Follow Us